nj property tax relief check

Increasing that income threshold would allow the Murphy administration to. We will begin mailing 2021 applications in early March 2022.

Property Tax Appeal Tips To Reduce Your Property Tax Bill

How to File for Property Tax Relief and Check Your Status.

. For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did. Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov. Call the Senior Freeze Information Line at 1-800-882-6597 for more information.

Phil Murphy and lawmakers agreed to in September with about 800000 New Jersey residents eligible to receive a 500. The checks part of a deal Murphy cut with top Democratic lawmakers last year to institute a millionaires tax come as the governor vies for. Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits.

Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. The deadline to file the application is October 31 2022. It was established in 2000 and is an active participant in the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators.

Phil Murphy unveiled Thursday. Another claimant statecity that has a personal income tax set-off agreement with New Jersey. However New Jerseys most expensive property-tax relief program according to budget documents allows homeowners regardless of their annual income to deduct up to 15000 in local.

About the Company Nj Property Tax Relief Checks. That would add at least 100000 to the current income cutoffs for direct property-tax relief benefits. Although the service is accredited.

For example if an eligible family paid 250 in taxes they would get a 250 rebate check. The latest round of benefits scheduled to be paid in May 2022 are intended to offset the property-tax bills from 2018. For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms.

To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019. CuraDebt is a debt relief company from Hollywood Florida. About the Company Nj Property Tax Relief Fund Check 2021.

If its approved by fellow Democrats who. The deadline for filing for the 2017 Homestead Rebate was December 2 2019. Have a copy of your application available when you call.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. For New Jersey homeowners making up to 250000 rebates would be applied as a percentage of property taxes paid up to 10000. The rebate check program comes as part of a 319 million package that Gov.

Tax Collector Check the Box on Part II of PTR-1A2A if there was a tax appeal. Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219. All property tax relief program information provided here is based on current law and is subject to change.

For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. In Fiscal Year 2022 over 760000 New Jersey families will receive an up to 500 tax rebate due to the Millionaires Tax enacted by the Governor and. If we apply your refund or credit to any debts.

All Property Tax Relief Benefits are Subject to Change. For information call 800-882-6597 or to visit the NJ Division of Taxation. New Jersey Income Tax PO Box 444 Trenton NJ 08646-0444.

The Homestead Benefit program provides property tax relief to eligible homeowners. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled. Use our Check Your Refund Status tool or call 1-800-323-4400 toll-free within NJ NY PA.

New Jersey Gross Income Tax Write your Reference Number on the memo line. Mail the check and notice voucher to. The main reasons behind the steep rates are high property values and education costs.

If a reimbursement has been issued the system will tell you the amount of the reimbursement and the date it was issued. Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. It was founded in 2000 and is an active part of the American Fair Credit Council the US Chamber of Commerce and is accredited through the International Association of Professional Debt Arbitrators.

Renters making up to 100000 would be eligible for direct payments. To check the status of your homestead rebate for 2017 call 877-658-2972. 2021 Senior Freeze Applications.

All property tax relief program information provided here is based on current law and is subject to change. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader.

Property Tax Reimbursement Hotline. Forms are sent out by the State in late Februaryearly March. The most anyone can get back is 500.

If you need to check the status of your homestead benefit for benefit years 2016 2015 or 2014 click here. Senior Freeze Property Tax Reimbursement Program. For those who qualify the checks are supposed to effectively freeze property-tax bills that now average an all-time high of 9112 in New Jersey.

Residents who paid less than 500 in income tax will receive an amount equal to what they paid.

Nj Property Tax Relief Program Updates Access Wealth

Back Tax Help Johnson City Tn 37601 M M Financial Blog Tax Help Back Taxes Help Irs Taxes

Freehold Township Sample Tax Bill And Explanation

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Township Of Nutley New Jersey Property Tax Calculator

Deducting Property Taxes H R Block

How Taxes On Property Owned In Another State Work For 2022

Property Taxes By State In 2022 A Complete Rundown

Freehold Township Sample Tax Bill And Explanation

Township Of Nutley New Jersey Property Tax Calculator

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

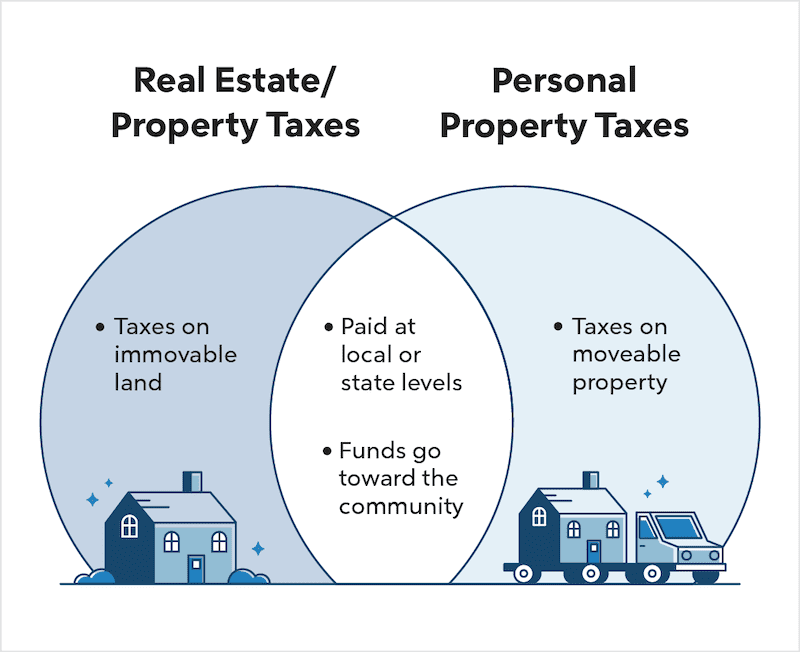

Real Estate Taxes Vs Property Taxes Quicken Loans

Local Nj Business Videos Business Video Business Dental Services

Looking For A Form Nj 1040 Es Estimated Tax Worksheet For Individuals Check Our Website To Find Free Printable R Personalized Bible Cherished Memories Album

Cancellation Of Homestead Deduction The District Of Columbia Here S A Free Template Create Ready To Use Forms A Deduction District Of Columbia How To Apply

Benefits Of Owning A Home Advantages Of Owning A Home Re Max Nj Home Ownership Home Buying Buying A New Home

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning A Home You Real Estate Buying First Home Estates